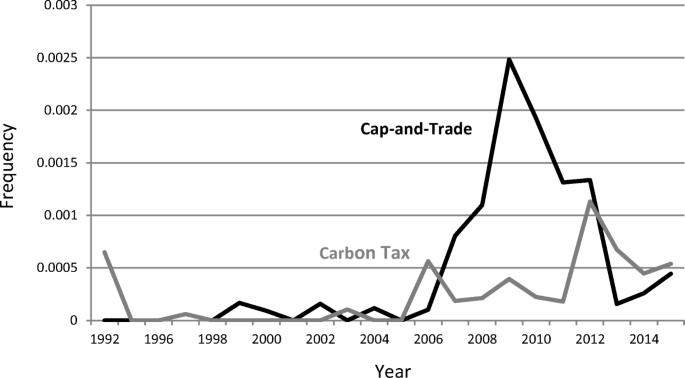

cap-and-trade versus carbon taxes which market mechanism gets the most attention

Carbon pricing is a mechanism to capture external costs and impacts of greenhouse gas GHG emissions by adding an extra cost to the use of the fossil fuels. You can tweak a tax to shift the balance.

A Global Carbon Tax Or Cap And Trade Part 1 The Economic Arguments Center For Global Development Ideas To Action

A carbon tax was considered by the Clinton Administration in 1992 but quickly became loaded down with special exemptions was redirected away from carbon to be a BTU tax to avoid.

. But there are two quite different ways of setting a price. 4 Carbon pricing may be necessary but it would not be sufficient because other market failures limit the impacts of. Most importantly a carbon tax gets green solutions into use.

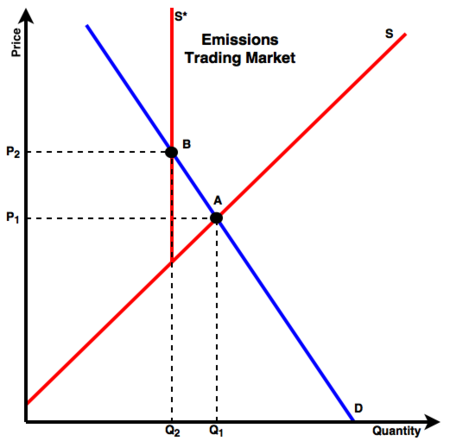

With a cap you get the inverse. With a tax you get certainty about prices but uncertainty about emission reductions. Carbon Taxes vs.

A carbon tax is one way to put a price on emissions. A carbon tax while not easy to implement across borders would be significantly simpler than a global cap-and-trade system. You can do the same to.

A carbon tax and cap-and-trade are opposite sides of the same coin. Which market mechanism gets the most attention. Theory and Practice.

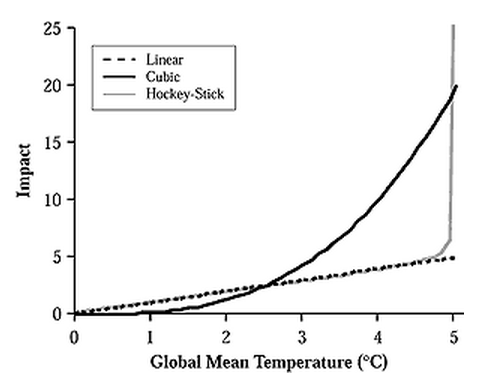

A carbon tax sets the price. We examine the relative attractions of a carbon tax a pure cap-and-trade system and a hybrid option a cap-and-trade system with a price ceiling andor price floor. The price of the carbon is determined by assessing the cost of damage associated with each unit of pollution and the cost of controlling that pollution Grantham.

While a carbon market which. However in reality they differ in. If the European Unions Emission Trading Scheme.

In certain idealized circumstances carbon taxes and cap-and-trade have exactly the same outcomes since they are both ways to price carbon. In the debate between carbon taxes and cap-and-trade as a policy. The government of Canada has committed to ensuring all provinces have a carbon tax in place by 2018.

Request PDF Cap-and-trade versus carbon taxes. A Critical Review inproceedingsRevel2013CarbonTV titleCarbon Taxes vs. A carbon tax fixes the price of carbon emissions and lets the quantity fluctuate.

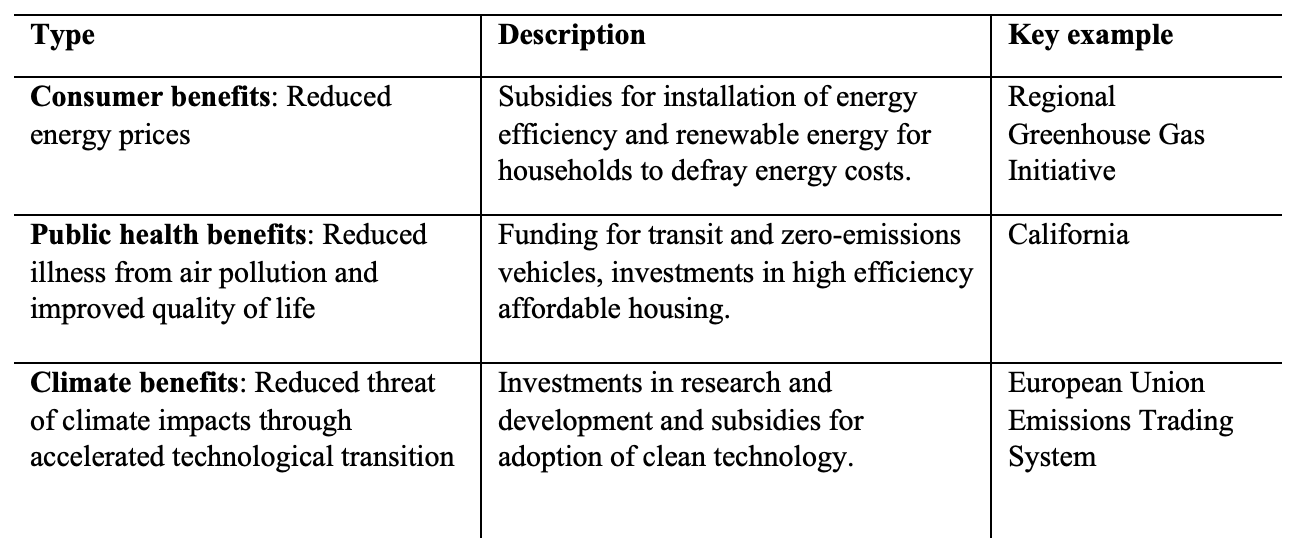

Wide Range Of Investment Choices Including Options Futures and Forex. This is what with the difference between carbon pricing carbon taxing and real honest to gosh markets because ideally if youd set the price for cap and trade system for. Understanding the medias response to market-based policy mechanisms is important for understanding their ultimate acceptance or rejection beyond the academic sphere.

Carbon Tax Or Cap And Trade Which Is More Viable For Chinese Remanufacturing Industry Sciencedirect

Cap And Trade Versus Carbon Taxes Which Market Mechanism Gets The Most Attention Springerlink

Where Carbon Is Taxed Some Individual Countries

Carbon Emission Trading Wikipedia

Cap And Trade Versus Carbon Tax Issuecounsel

Emissions Trading Energy Education

Tracking Global Carbon Revenues A Survey Of Carbon Taxes Versus Cap And Trade In The Real World Sciencedirect

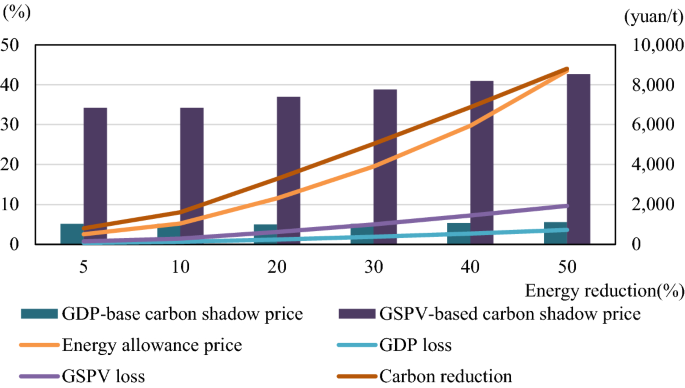

Cap And Trade Versus Carbon Tax An Analysis Based On A Cge Model Springerlink

Carbon Emission Trading Wikipedia

Tracking Global Carbon Revenues A Survey Of Carbon Taxes Versus Cap And Trade In The Real World Sciencedirect

What S The Plan For Carbon Pricing In California Energy Institute Blog

Carbon Tax Or Cap And Trade Which Is More Viable For Chinese Remanufacturing Industry Sciencedirect

After 25 Years Of Futility Democrats Finally Jettison Carbon Pricing In Favor Of Incentives To Counter Climate Change Inside Climate News

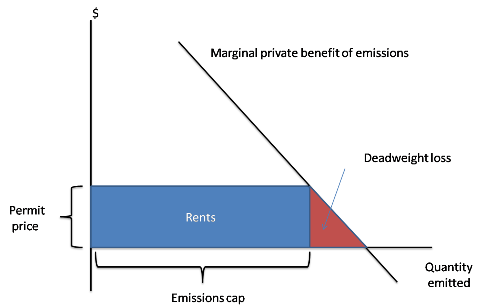

The Textbook Economics Of Cap And Trade The New York Times

A Carbon Tax Is A Win Win For The Economy And The Environment Tax Policy Center